TurboTax 2023 Online Tax Preparation Software

Turbo Tax 2023 Tax Software Review

What better way is there to start the New Year then with a tax program that ensures you the biggest refund. TurboTax 2023 does just that! In fact, they guarantee it!

For 2023, certain tax deductions and benefits previously available to millions of Americans will no longer be available. Additionally, there are many changes to the rate structures, exemptions, phase outs etc.

A Summary of how changes in the Tax Law for 2023 may effect you, include:

New tax law updates include sharp limits to itemized deductions and an overhaul of tax withholdings that apply to employee wages.

Even the income tax return Form 1040 is getting a major makeover. Now you a postcard-sized 1040 with six worksheets filers that will need to be waded through for claiming above-the-line deductions and credits you may qualify for.

Tax returns will look a lot different they in previous years. It’s not just the forms, but

actual terms of what's deductible that has changed. This will make a difference in how

your income taxes are calculated.

These are the key planning areas you should review with your accountant this summer.

TurboTax 2023 can keep you on top of Income Tax Changes for 2023 which will become part of

your income tax filing for the new tax season.

Tax Law Changes:

Under the new tax laws, the IRS tax withholding tables that employers use have been overhauled along with W-4 Tax Forms. These forms determine how much income tax should be withheld from employee paychecks based on the number of allowances each tax payer claims and how much they earn.

If you haven’t reviewed your withholding since the new tables came out, now is a good time to do it.

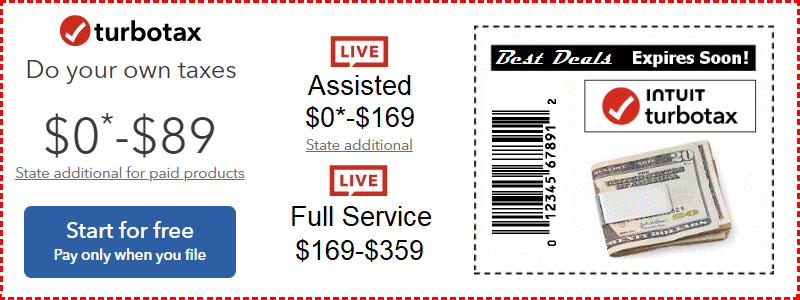

TurboTax

2023 Software Editions

TurboTax

2023 Software Editions

In previous years, it may have made sense to withhold less under certain circumstances: For instance, if you itemized your tax deductions.

This may no longer be a good idea, especially since the standard tax deduction has nearly doubled to $12,000 for singles and $24,000 for married tax filers filing jointly in 2023.

It will be a painful financial surprise if you’re under-withheld, I encourage a withholding review, especially for employees in a dual income household.

Using a Withholding Calculator to determine the proper amount to be withheld is a wise move.

Tax Changes, TurboTax can help in 2023

The new tax code increased the standard deduction, while changing many itemized deductions.

This includes a $10,000 cap on the amount of state and local taxes you can claim, along with the elimination of miscellaneous itemized deductions like un-reimbursed employee expenses and investment fees. Schedule A lists itemized deductions, so strategize to determine changes you need to make.

Intuit Turbo Tax 2023 keeps you on top of your Standard Deductions:

According to the IRS, about two out of every three US taxpayers claim the standard deduction annually on their income tax returns. 2023 tax laws should trigger a review of this law and how it applies to their 2023 tax return.

TurboTax

2023 Online Editions

TurboTax

2023 Online Editions